from Those in the OKC area looking to support a great company and CEO AND get quality product.

Real Fiscal Conservatism

Steve Anderson's prescription for conservative govt. reform.

Tuesday, July 14, 2020

Those in the OKC area looking to support a great company and CEO AND get quality product.

from Those in the OKC area looking to support a great company and CEO AND get quality product.

Saturday, July 11, 2020

Buy Goya products! I know I will be going forward. https://www.goya.com/en/products

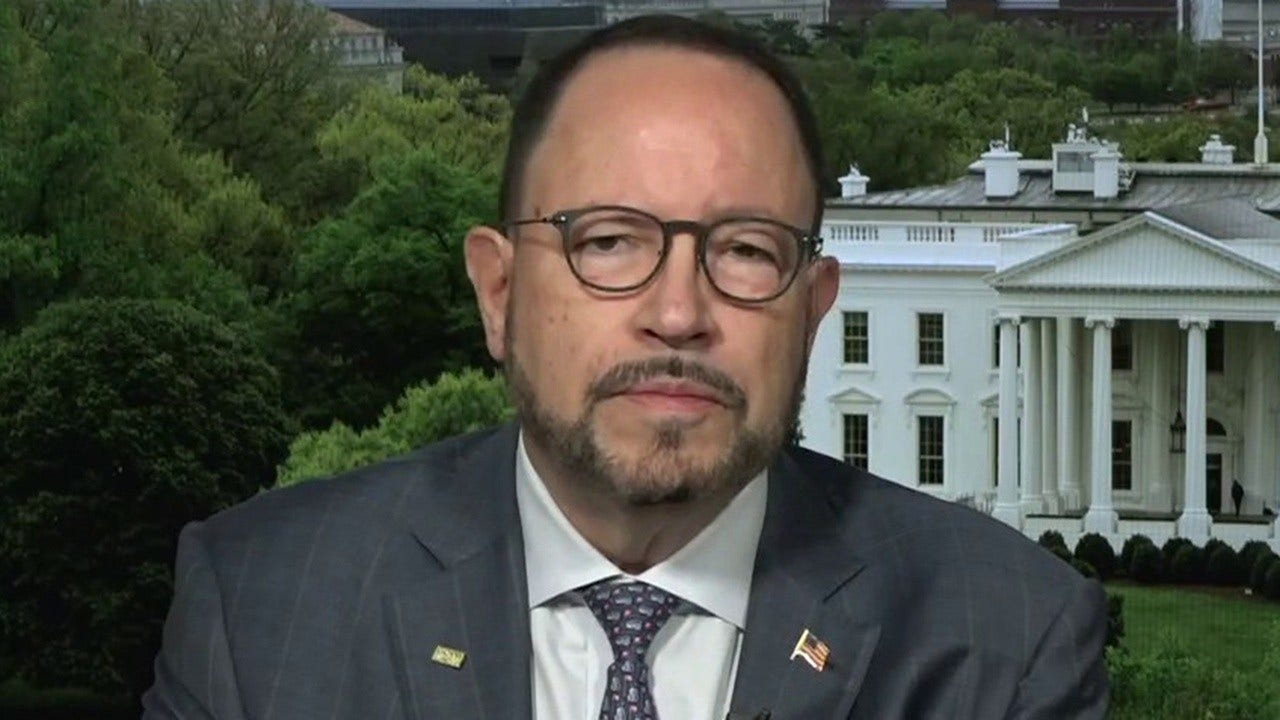

Goya Foods CEO won't apologize in face of boycott, backlash for pro-Trump remarks: 'Suppression of speech'

Goya Foods President and CEO Bob Unanue said on Friday that he is not backing down in the face of a boycott over his visit to the White House.

from Buy Goya products! I know I will be going forward. https://www.goya.com/en/products

https://www.facebook.com/steveacpa/posts/958735434597297?notif_id=1594390504460994¬if_t=page_post_reaction

Real Fiscal Conservatism in Government

Why Every Person Should Care About the Stock Market

Joe Biden’s statements about the stock market are continuing proof of how little he understands how capitalism works for nearly everyone.

For those who invest directly in the market the importance is obvious so I will avoid wasting your time on that category of Americans. Instead, let’s start with government union members like the teachers union members. This is a largely Democrat voter base who may fail to understand how their defined benefit retirement plans are dependent on the market. Their pension plans invest in the stock and bond market in order to accumulate wealth to cover the payments owed to those union members. A fall in the value of the stocks limits or eliminates the ability of those pension funds to give increases in payments known as Cost of Living Adjustments (COLAs). Without COLAs the fixed amount that teachers and others in these types of plans receive are negatively impacted by inflation. The simple way to look at it is to consider how large a Baby Ruth you could buy with a dollar ten years ago and what you can get for the same amount today. A significant difference that should drive home why they need the stock market to continue to go up in value.

For those who are still in the working class the amount of value in the stock market affects them even more. Large firms that dominate the stock market whose stock goes up in value are able to use those increases in value to borrow or issue stock at that value allowing them to grow their operations. There is a direct positive impact on the smaller privately owned firms that provide services to these companies or their employees. The expansion by these stock market companies provides increases in employment and that demand drives up wages. The economy before the virus should prove those points to even the most hardheaded liberal. The level of employment in all classes of labor and every segment of our population was undeniable.

Now how about the welfare population? For one thing the amount of people dependent on welfare goes down when employment goes up but even those still dependent on it benefit. A growing economy means growing revenues to the US Treasury which allows legislators to improve benefits to what is a smaller population of recipients.

The country in general benefits when the stock market is growing. Capital flows from the weaker markets like the EU and those with less stability and openness like the Chinese market. Pouring more capital into the market from these outside sources is just more gas on the fire. The Biden/Democrat socialist approach benefits the globalists like Soros and Koch at the expense of the vast majority of Americans.

from https://www.facebook.com/steveacpa/posts/958735434597297?notif_id=1594390504460994¬if_t=page_post_reaction

Wednesday, July 8, 2020

Asking for a friend: Does anyone in my FB friends have any knowledge of the effectiveness of the Proton Surgery center in Norman? Any information good or bad is very much appreciated!

from Asking for a friend: Does anyone in my FB friends have any knowledge of the effectiveness of the Proton Surgery center in Norman? Any information good or bad is very much appreciated!

Friday, June 26, 2020

I have begun posting on Real Fiscal Conservatism in Government again after a few weeks away from FB. I have a bit of data on why the unemployment numbers you are seeing are fake.

from I have begun posting on Real Fiscal Conservatism in Government again after a few weeks away from FB. I have a bit of data on why the unemployment numbers you are seeing are fake.

Thursday, June 4, 2020

The problem with a 24 hour news cycle the effect of good policy moves are lost on the viewers. Very much the private...

The problem with a 24 hour news cycle the effect of good policy moves are lost on the viewers. Very much the private sectors way of negotiating. The press obviously can't comprehend how this works and every Trump pronouncement is a catastrophe but the results of the verbal position don't get the same coverage. Here is one of those. https://www.wsj.com/…/china-to-allow-foreign-airlines-to-re…

from The problem with a 24 hour news cycle the effect of good policy moves are lost on the viewers. Very much the private...

Tuesday, May 26, 2020

Amazing how all of a sudden the NASDAQ is approaching its high and the S&P 500 has done quite well. IVW and NDAQ are ne...

Amazing how all of a sudden the NASDAQ is approaching its high and the S&P 500 has done quite well. IVW and NDAQ are nearing sell moves IMO if you bought well on the way down. I would say that both seem to have enough upside you won't hate yourself if you don't sell---I am keeping some small holdings in both. I am bullish on America in general as anyone who reads these postings knows but that is always with an eye towards the long run. I see a market that is going to bo...unce around for awhile but now having a trend line of highs that has a positive incline. In other words I am starting back to my more regular practice of selling winners and either repurchasing on the drops or re-balancing . I have always thought re-balancing your portfolio at bottoms was flawed reasoning with two major caveats: tax situations and/or those companies that may end up in Chapter 7. However, now as you sell winners it might be a good chance to do that.

from Amazing how all of a sudden the NASDAQ is approaching its high and the S&P 500 has done quite well. IVW and NDAQ are ne...

Subscribe to:

Comments (Atom)